Amadeus vs Sabre vs Galileo: Which GDS is Right for Your Travel Business?

Global Distribution Systems (GDS) are the backbone of the travel industry, handling millions of booking operations daily and connecting travel agencies, OTAs, and tour operators with airlines, hotels, and car rental services through one powerful network. Among the major players, Amadeus, Sabre, and Galileo stand tall, each offering unique features, global reach, and competitive advantages.

But when it comes to choosing the right one for your business, things can quickly get overwhelming. With all three GDS giants offering robust features and extensive travel content, it’s natural to ask: Which system is best suited for your travel business?

In this blog, we’ll break down Amadeus, Sabre, and Galileo, comparing their key features and strengths. So that you can confidently decide which platform is right for your travel business. First let’s know why businesses need a GDS system?

Why Are GDS Platforms Vital for Travel Business?

For travel agencies, OTAs, and corporate travel managers, a Global Distribution System (GDS) isn’t just a booking tool — it’s the central nervous system of business operations. A well-integrated GDS connects your business to airlines, hotels, car rentals, rail, and even cruise lines, all through a single unified platform.

Instead of negotiating individually with multiple suppliers, GDS platforms allow you to tap into real-time inventory, availability, and dynamic pricing from hundreds of providers worldwide. This translates to faster bookings, better margins, and more satisfied travelers. Here is the list what GDS brings you:

- Centralized access to flights, hotels, and car rentals from multiple suppliers

- Real-time inventory and pricing updates

- Streamlined booking and reservation management

- Increased efficiency and reduced manual workload

- Enhanced ability to serve both leisure and corporate accountants

- Competitive pricing and dynamic offers

- Expanded reach to global travel markets

- Supports NDC (New Distribution Capability) for better travel retailing

Major GDS Providers Powering the Global Travel Industry

Global Distribution Systems have changed, and these platforms act as a powerful intermediary, enabling seamless connectivity between travel suppliers and sellers through advanced technology and an extensive content network. Together these providers control more than 65% of the global GDS market.

Amadeus

Founded in Spain in 1987, Amadeus is one of the best GDS providers, used in over 190 countries with a 32% global market share.

Its key APIs cover flight booking, hotels, car rentals, fare optimization, and AI-driven personalization.

Sabre

Established in the USA in 1960 by American Airlines, Sabre holds 30% of the global air market, with a strong foothold in North America.

Offers Sabre Red 360 and Dev Studio APIs for travel shopping, reservations, loyalty, and itinerary management. If you’re planning to implement Sabre GDS for your business, here’s a detailed guide on how to integrate Sabre API.

Galileo (By Travelport)

Part of Travelport, Galileo originated in the UK and now operates in over 180 countries with a 22% global market share. Travelport Universal API provides unified access to air, hotel, car, pricing, and NDC content.

Amadeus vs Sabre vs Galileo – Detailed Comparison

Choosing the right GDS platform is important for travel agencies, as each system offers unique strengths in booking capabilities, global reach, integration, and support.

Here’s a detailed comparison of Amadeus, Sabre, and Galileo (part of Travelport), to help you understand how these platforms stack up across key features.

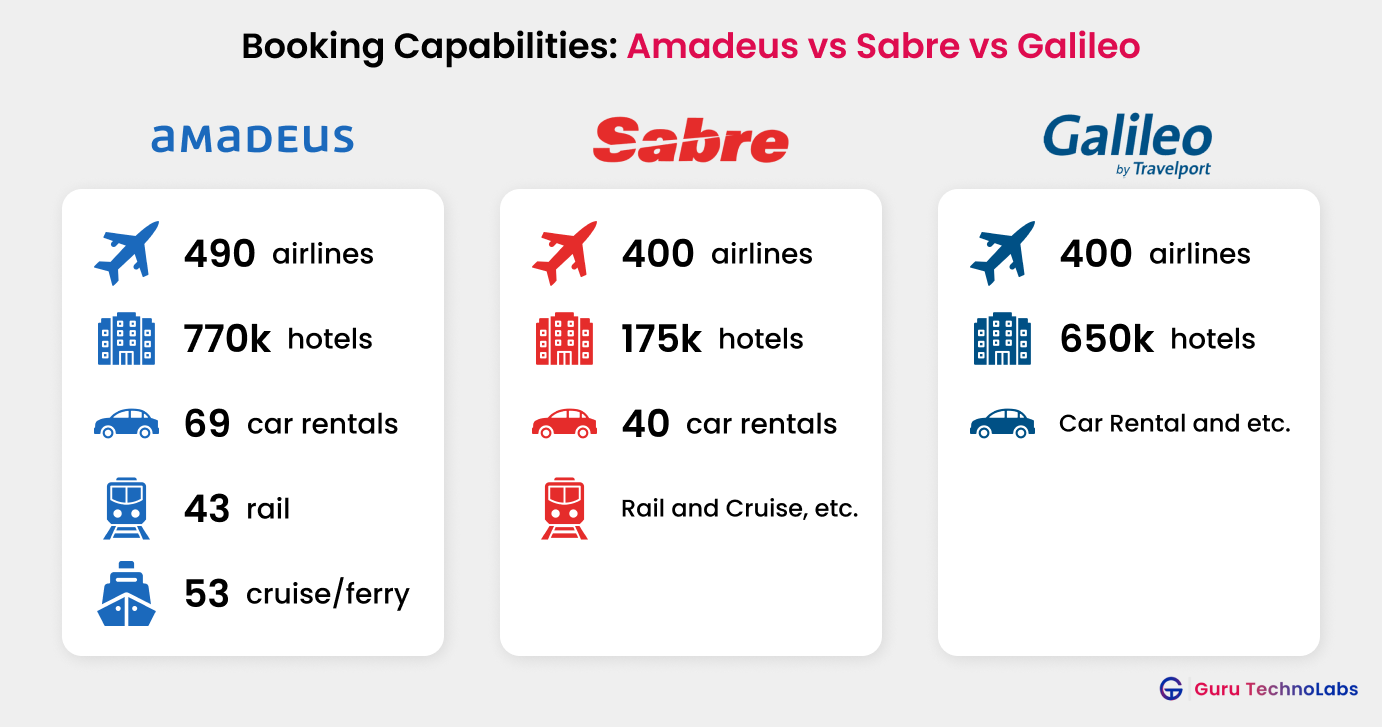

Booking Capabilities & Travel Coverage

Amadeus is renowned for its vast inventory, connecting to over 490 airlines, 770,000 hotel properties, 69 car rental companies, 43 rail carriers, and 53 cruise and ferry lines. It excels in both air and non-air bookings, making it a top choice for agencies seeking comprehensive content.

Sabre provides access to 400+ airlines, 175,000 hotels, 40 car rental brands, and a wide range of cruises and rail options. It is particularly strong in airline and hotel bookings, with a reputation for robust fare aggregation and dynamic packaging.

Galileo (Travelport) offers connectivity to over 400 airlines, 650,000 hotel properties, major car rental companies, and global rail and cruise content. Galileo is especially valued for its multi-source content aggregation and flexible APIs, supporting a wide range of travel products, many agencies leverage Travelport API integration to access these capabilities efficiently.

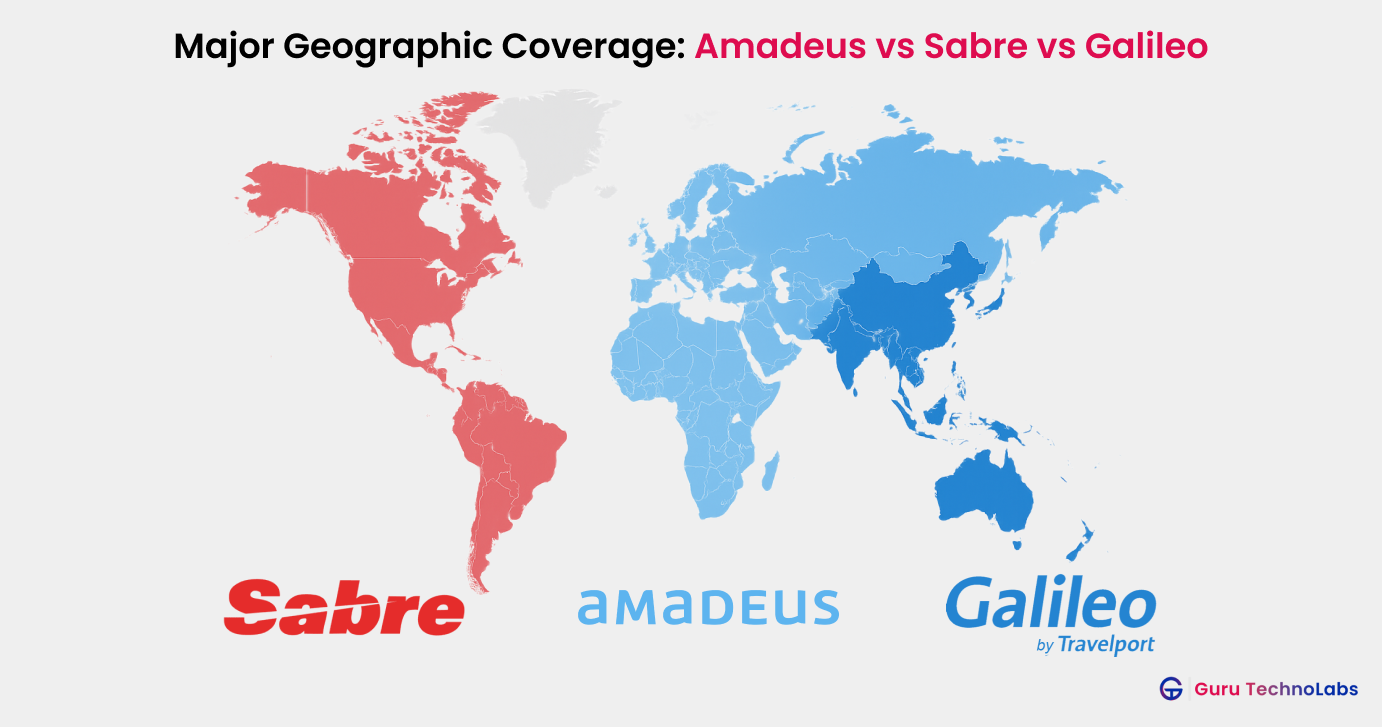

Geographic Coverage and Market Reach

Amadeus dominates in Europe, the Middle East, and Africa, with a presence in over 190 countries. Its stronghold in these regions makes it ideal for agencies serving international and corporate clients.

Sabre is the leader in North America and Latin America, but also has a significant footprint in Asia-Pacific. Its extensive reach supports agencies with a global or transatlantic focus.

Galileo (Travelport) is known for its balanced global presence, particularly strong in the Americas, Europe, and Asia-Pacific. It is often chosen by agencies seeking a truly international solution.

User Interface and Ease of Use

Amadeus offers a modern, intuitive interface with both desktop and web-based options. Its learning curve is moderate, and it is praised for customizable workflows and robust reporting tools.

Sabre features a user-friendly interface with Smartpoint and Red Apps, which streamline complex bookings. It is well-liked for its speed and efficiency, especially for high-volume agencies.

Galileo (Travelport) provides a flexible interface with Smartpoint, supporting both command-line and graphical modes. It is considered easy to learn, especially for agencies familiar with traditional GDS commands.

API & Technology Comparison, Integration with OTAs

Amadeus stands out for its extensive API suite, supporting XML, REST, and SOAP protocols. Its strong NDC adoption makes it future-ready for modern airline retailing. It integrates seamlessly with OTAs, travel management companies, and custom travel tech solutions. For a practical walkthrough of integration, here’s our detailed post on how to integrate Amadeus API.

Sabre offers robust APIs (including REST/ JSON) and developer tools, making it easy to connect with OTAs, mobile apps, and third-party platforms. Its NDC capabilities are industry-leading.

Galileo is highly regarded for its open APIs and middleware support, enabling smooth integration with OTAs and travel portals. Its API documentation and support are strong points for developers.

Customer Support and Training

Amadeus provides amazing customer support, including round-the-clock helpdesks, online resources, and in-depth training programs for agencies of all sizes.

Sabre is known for responsive customer service and a wide range of training modules, including certification courses and live webinars.

Galileo offers dedicated support teams and extensive training, both online and onsite, to ensure agencies maximize platform value.

Commercial Model & Pricing

Amadeus typically charges a setup/licensing fee (from a few thousand dollars for smaller agencies) plus per-segment booking fees of $0.50–$1.50. Training and certification can cost per user. Its ROI is strong for agencies leveraging negotiated corporate fares and expense integrations, especially in high-volume international markets.

Sabre uses a transaction-based pricing model with per-booking costs in the $0.20–$1.00 range, alongside optional licensing fees for premium modules. Training programs are relatively affordable, and commissions from airline/hotel partnerships often offset costs. Sabre’s ROI is attractive for agencies handling large airline + hotel volumes.

Galileo (Travelport) is known for its flexible commercial terms, often with lower entry fees and subscription-style licensing for OTAs. Transaction charges are competitive ($0.25–$0.75 per segment), and many training/certification costs are bundled into contracts.

GDS Integration Cost Explained

Special Features & Value-Added Tools

Amadeus excels in ancillary services (seat selection, baggage, upgrades) and offers advanced corporate travel tools, making it a strong fit for TMCs (Travel Management Companies) and enterprise clients. Its early and deep adoption of NDC standards positions it well for modern airline retailing and personalized offers.

Sabre benefits from its longstanding airline partnerships, giving agencies access to rich fare families, branded fares, and ancillary bundles. Its dynamic packaging tools and Red Apps ecosystem help agencies customize offers, while strong NDC connectivity keeps it competitive in future-ready distribution.

Galileo (Travelport) stands out for its diverse hotel content and strong access to low-cost carriers (LCCs), making it popular with OTAs and leisure-focused agencies. Its multi-source aggregation delivers flexibility across air, hotel, and rail, while supporting ancillaries and NDC-enabled retailing at scale.

Summary of Amadeus vs Sabre vs Galileo Comparison

| Feature | Amadeus | Sabre | Galileo |

|---|---|---|---|

| Booking Capabilities | 490+ airlines, 770,000 hotels, 69 car rentals, 43 rail, 53 cruises | 400+ airlines, 175,000 hotels, 40 car rentals, cruise & rail | 400+ airlines, 650,000 hotels, major car rentals, rail, and cruise |

| Geographic Coverage | Strongest in Europe, Middle East & Africa; presence in 190+ countries | Strongest in North America & Latin America, growing Asia-Pacific footprint | Balanced global presence across Americas, Europe, Asia-Pacific |

| User Interface | Modern/ Customizable, & Desktop/web | User-friendly, smartpoint, Red Apps | Flexible, Smartpoint, command-line/GUI |

| API & Tech Features | XML, REST, SOAP APIs; strong OTA/TMC integration; advanced NDC adoption | REST/JSON APIs, top NDC leader; strong developer tools & mobile integrations | Open APIs & middleware; strong OTA/travel portal support; solid developer documentation |

| Support & Training | 24/7 support, in-depth training | Responsive support, certification, webinars | Dedicated teams, online/onsite training |

| Commercial Model & Pricing | Setup/licensing fees + per-transaction costs, training per user; strong ROI with negotiated fares & expense integrations | Transaction-based + optional licensing; affordable training; commissions offset costs; good for high-volume airline + hotel agencies | Flexible terms; low entry barriers; subscription-style licensing for OTAs; competitive pricing; training often bundled |

| Special Features | Strong ancillaries, corporate tools, advanced NDC retailing | Strong airline partnerships, branded fares, ancillaries, dynamic packaging, Red Apps | Strong hotel & LCC content, multi-source aggregation, ancillaries, NDC-enabled retailing |

This comparison highlights the strengths of each platform, helping agencies choose the best fit for their business model and market focus.

We’ve helped dozens of OTAs and travel agencies seamlessly integrate Amadeus, Sabre, and

Galileo into their portals. Let’s build a solution that fits your unique needs.

Choosing the Right GDS for Your Travel Business

After reviewing the strengths and features of leading GDS platforms, it’s clear that choosing the right GDS for your travel business is a decision that impacts your efficiency, service quality, and long-term growth.

The best fit depends on several factors such as :

- Agency size & specialization

- Geographic focus

- Content needs (air, hotel, trails, etc.)

- Technology integration

- Support & training

It’s also important to consider the provider’s global reach, cost structure, user experience, and customer support. By carefully evaluating these aspects, you can choose the GDS that matches your business requirements and helps you deliver exceptional value to your customers.

In 2025, Amadeus, Sabre, and Galileo, all three, continue to stand out as the dominant GDS players, each having firmly established their presence on a global scale. They leverage advanced technologies like AI-powered automation, dynamic pricing, and cloud-based infrastructure to stay ahead in a highly competitive landscape.

Conclusion

Every travel business requires a good GDS that caters to all of its needs, after all, it gives the major advantage of personalization that can be helped to generate more and more revenues.

Guru TechnoLabs is one of the best travel portal development companies that specializes in integration with top GDS systems such as Amadeus, Sabre, and Galileo. Here No matter with whom you sign up, we provide the solution below according to your needs.

Contact us, and our team of experts will help you achieve privileges that others don’t.

Frequently Asked Questions

It depends on your market focus. Amadeus is stronger in Europe, the Middle East, and Africa with vast non-air content, while Sabre dominates in North America and Latin America with strong airline partnerships and dynamic packaging. Neither is strictly “better”—the right choice depends on your target customers and regions.

Galileo (Travelport) is widely used by online travel agencies (OTAs), mid-sized travel agencies, and leisure-focused businesses. It’s especially popular with agencies that need rich hotel content and strong connectivity with low-cost carriers (LCCs).

The biggest difference lies in geographic strength and focus.

- Amadeus: Strongest in EMEA, with broad air and non-air content (hotels, rail, cruises).

- Sabre: Strong in the Americas, with deep airline partnerships and advanced fare management tools. Both provide NDC support, APIs, and robust booking tools—but their regional dominance and content focus differ.

American Airlines primarily uses the Sabre GDS, reflecting Sabre’s strong market position in the U.S. and North America. However, American Airlines also distributes content via Amadeus and Travelport, ensuring global reach.

Many U.S.-based and international airlines use Sabre for distribution, including American Airlines, Delta Air Lines, United Airlines, and several leading Latin American and Asia-Pacific carriers. Sabre’s strong airline partnerships make it a top choice for agencies selling transatlantic and regional flights.

Not necessarily, it depends on your needs. Amadeus offers broader content and strong corporate travel tools, while Galileo is valued for its hotel and LCC coverage and flexible commercial terms. Agencies serving leisure travelers or OTAs may prefer Galileo, while corporate-focused agencies often lean toward Amadeus.

Both Sabre and Amadeus are leading Global Distribution Systems (GDSs). They act as intermediaries between travel agencies and travel suppliers (airlines, hotels, car rentals, rail, cruises). By aggregating availability, fares, and booking tools, they help agencies deliver seamless travel services to customers worldwide.

Sabre and Travelport are both enterprise-grade GDS platforms, but they serve slightly different agency needs and market strengths.

Sabre is generally the better choice for travel agencies that:

- Operate primarily in North America

- Focus heavily on airline bookings

- Require strong corporate travel, policy control, and mid–back office integrations

- Work closely with U.S.-based carriers and large airline networks

Travelport (via Galileo, Worldspan, and Apollo) is often more suitable for agencies that:

- Serve international or multi-regional markets

- Need strong hotel, LCC, and multi-content distribution

- Manage leisure, group, or mixed travel bookings

- Prefer flexible workflows across flights, hotels, and ancillary services

In simple terms:

- Choose Sabre if your business is airline-centric and North America–focused.

- Choose Travelport if you need broader global reach, stronger hotel inventory, and multi-content flexibility.

Amadeus primarily focuses on travel distribution, airline IT, and passenger service systems, while providers like SITA specialize more in airport operations, connectivity, disruption management, and traveler-centric airport technologies. The right choice depends on whether an airline or airport is prioritizing distribution and passenger services or operational efficiency and airport infrastructure.

Amadeus APIs are widely used for accessing global airline inventory through established GDS infrastructure, while modern APIs like Duffel focus on direct airline connections and developer-friendly integration. The right choice depends on whether a business prioritizes broad legacy coverage or direct, API-driven airline access.